Pupil loans for veterans: 4 methods to fund your school schooling

Our aim right here at Credible Operations, Inc., NMLS Quantity 1681276, known as “Credible” under, is to provide the instruments and confidence that you must enhance your funds. Though we do promote merchandise from our companion lenders who compensate us for our providers, all opinions are our personal.

Should you’re a veteran or active-duty service member and also you want pupil loans for school, listed below are 4 methods you’ll be able to pay on your greater schooling. (Shutterstock)

Should you’re a veteran attempting to determine the right way to pay for school, the navy will cowl a lot of your greater schooling prices in alternate on your service. The precise quantity the federal government pays is dependent upon when and for the way lengthy you served.

If the navy doesn’t cowl the complete value of your tuition, you’ve gotten different choices to fill the gaps in funding. Listed here are 4 ways in which veterans and their dependents will pay for school.

Non-public pupil loans are one possibility to assist pay for school. Credible helps you to examine personal pupil mortgage charges from a number of lenders, multi function place.

1. Apply for Put up-9/11 GI Invoice (Chapter 33) schooling advantages

The Put up-9/11 GI Invoice (Chapter 33) gives instructional assets and housing to people who served no less than 90 days on or after Sept. 11, 2001. You’re additionally eligible for this profit in the event you had been discharged for a service-related incapacity after 30 days.

Should you qualify for max advantages, the federal government will cowl the complete value of the schooling and charges to attend a public, in-state college. Should you attend college greater than half-time, you’ll obtain cash for housing and as much as $1,000 for books and provides per college yr.

As well as, you might be able to obtain cash that will help you transfer from a rural space to attend college. Should you stay in a county with six or fewer individuals per sq. mile and are shifting no less than 500 miles to attend college, you could qualify for a one-time $500 fee to cowl your shifting prices.

You’ll want the next paperwork to use:

- Social Safety quantity

- Checking account data for direct deposit

- Your schooling and historical past with the navy

- Details about the college you intend to attend

You may apply by mail or in individual at a VA regional workplace close to you.

GI Invoice for dependents

Some veterans could also be eligible to switch their unused advantages to a partner or dependent kids. To qualify, all the next statements should be true:

- You’ve accomplished no less than six years of service.

- You conform to an extra 4 years of service.

- The person receiving the advantages is enrolled within the Protection Enrollment Eligibility Reporting System.

If the Division of Protection approves the Switch of Entitlement, your partner or dependent little one might obtain cash to cowl their tuition, housing, and provides.

If that you must take out personal pupil loans, go to Credible to examine personal pupil mortgage charges from numerous lenders in minutes.

2. Full the FAFSA and apply for scholarships

If the Put up-9/11 GI Invoice doesn’t absolutely cowl your tuition, the subsequent step is to fill out the Free Utility for Federal Pupil Help (FAFSA) to see in the event you qualify for any federal grants. These are sometimes awarded to undergraduate college students, and this cash doesn’t should be repaid.

Colleges use the data in your FAFSA to find out whether or not you’re eligible to obtain federal grants. And quite a lot of grants can be found which can be particularly geared towards navy members and their dependents.

For instance, kids of veterans who died in service in both Iraq or Afghanistan after 9/11 could also be eligible for the Iraq and Afghanistan Service Grant. This grant is the same as the quantity of a most Pell Grant, however it may well’t exceed your complete value of attendance for the college yr.

3. Take out federal loans

When you’ve submitted the FAFSA, you’ll study whether or not you’re eligible for any federal pupil loans. Federal loans come from the U.S. Division of Training and have decrease charges and extra borrower protections than personal pupil loans.

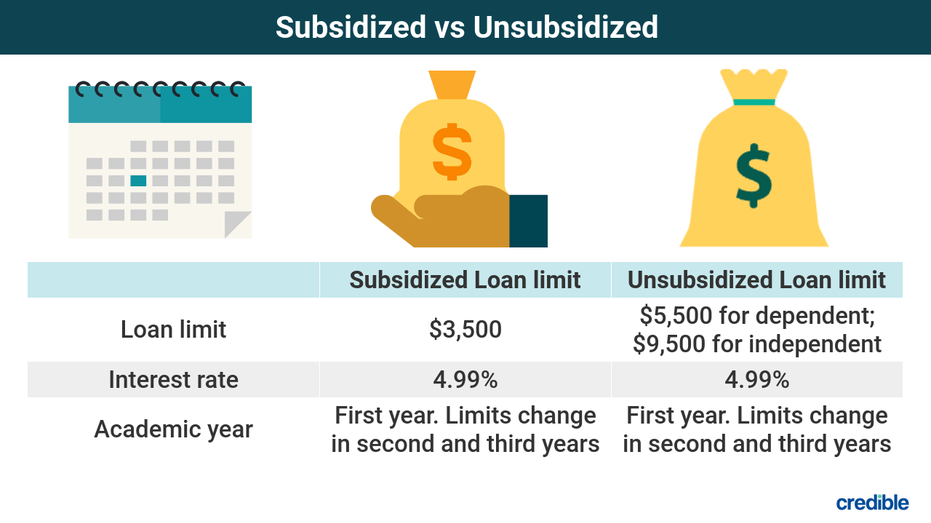

It’s good to find out about two principal varieties of Federal Direct Pupil Loans — backed and unsubsidized. Sponsored pupil loans can be found to undergraduate college students who can display monetary want. The federal government pays the curiosity on these loans so long as you’re enrolled in class no less than part-time, for the primary six months after you allow college, and when your mortgage is in deferment.

Compared, unsubsidized pupil loans can be found to all undergraduate college students no matter whether or not they can display monetary want. However you’re chargeable for paying the curiosity when you’re nonetheless in class.

Right here’s a better take a look at the distinction between every kind of federal pupil mortgage:

4. Think about personal pupil loans to fill the hole

Should you nonetheless have gaps in your instructional funding, you could wish to apply for personal pupil loans. Non-public loans can be found via banks, credit score unions, and on-line lenders. They’re an excellent possibility for debtors who want funding past what the federal mortgage limits permit.

Should you apply for personal pupil loans, it’s vital to match your choices amongst a number of totally different lenders. This may will let you qualify for probably the most favorable charges and phrases in your mortgage.

If you’re evaluating lenders, you’ll wish to contemplate the rates of interest you’re being provided. However you also needs to contemplate your reimbursement plan, whether or not there’s a cosigner launch possibility, the quantity of charges your lender fees, and any deferment or pupil mortgage forgiveness choices.

With Credible, you’ll be able to examine personal pupil mortgage charges with out affecting your credit score.