Meta Platforms: Largest Alternative In This Recession (NASDAQ:META)

Chip Somodevilla/Getty Photographs Information

A 12 months in the past, Meta Platforms, Inc. (NASDAQ:META) was buying and selling at $385 per share. Everybody wished to purchase the world’s main social-network firm that was investing closely in such a futuristic market section as digital actuality.

After precisely one 12 months, Meta is buying and selling at $145 per share, and nobody desires to purchase an organization that has stopped rising and is losing massive sums of cash on a market section that failed earlier than it was even born. What is going on now in Meta is a well-executed instance to indicate how fickle the human thoughts is in terms of investments. From high firm to flop firm in a single 12 months. It takes little to go from a interval of irrational euphoria to one in every of unwarranted pessimism. As is commonly the case, the reality in all probability lies within the center, and that’s what I’ll attempt to show on this article.

Evolution of registered customers

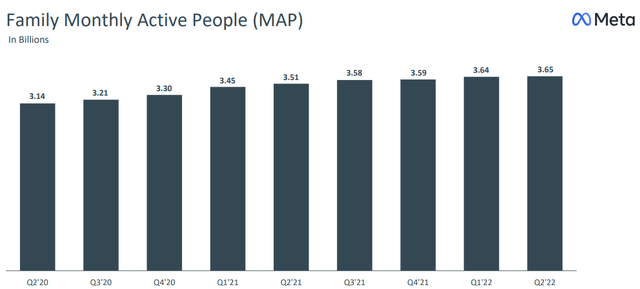

First, let’s go over how registered customers to Meta apps have diversified over the previous few years and particularly over the previous 12 months. After a 62{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce} worth drop, I anticipate that lively customers have dropped dramatically.

Meta Q2 2022

Really, probably not. In actual fact, month-to-month lively individuals have elevated to three.65 billion. There are increasingly more individuals who over the course of a month connect with a number of apps together with Fb, Instagram, Messenger, and WhatsApp. To be extra exact, the advance has not solely been there on a month-to-month foundation but additionally each day.

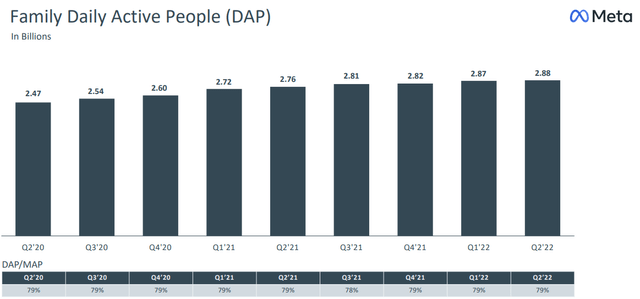

Meta Q2 2022

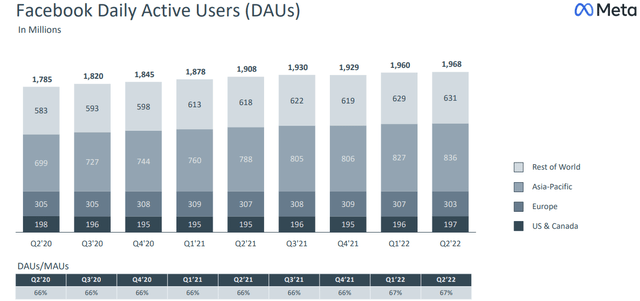

2.88 billion individuals use one in every of Meta’s apps each day. Contemplating that the world inhabitants related to the Web represents 5.03 billion, I believe it goes with out saying how influential and dominant this firm is. As well as, right here is one other picture for individuals who declare that Fb is a dying app.

Meta Q2 2022

Day by day customers proceed to extend, particularly in the remainder of the world and Asia. For that matter, it’s laborious to think about that progress will come from the U.S., Canada, and Europe, since a saturation level has been reached.

Total, although sluggish, progress has been there even if there are 3.65 billion month-to-month customers. After all, it’s unreasonable to anticipate excessive progress charges for the reason that world inhabitants is restricted. There could come a time sooner or later when there isn’t a extra progress, however with so many customers at one’s disposal, I truthfully don’t see it as such an enormous drawback. In any case, Meta has extra customers than a 12 months in the past, nonetheless an awesome area however its worth has plummeted 62{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce}.

The construction of social networks

Staying on the subject of dominance and aggressive benefit, analyzing the underlying mechanism of social networks is essential to understanding how advanced it’s for any new firm to emerge on this market. “The primary aim” of social networks is to create a web based community inside which it’s attainable to work together with a number of individuals. Now, when inside this market we’ve got an organization like Meta that has greater than 3 billion customers, it’s nearly sure that the primary aim will likely be assured, since nearly everyone seems to be subscribed to one in every of its Apps. If any new firm desires to compete with Meta, it can have huge problem attracting new clients because it can’t instantly assure the primary aim. Who would enroll on a social the place there are few members? Who would enroll on a social the place the individuals they wish to work together with are usually not current? The one incentive could be to enroll as a result of this new social community ensures a number of options that maybe Instagram or Fb do not need.

Nevertheless, even on this eventuality, the result doesn’t change since these sorts of improvements are usually not patentable. When Snapchat (SNAP) launched tales, there was a speedy enhance in customers, however the second Instagram copied this function, customers moved again to Zuckerberg’s app. When an organization has such a lot of every day customers, it’s unlikely that it may well lose its aggressive edge, not least as a result of it could imply altering the habits of billions of individuals.

Personally, I imagine that the one sure approach to weaken Meta is a world discount in social community utilization, however even this risk is kind of distant. It has been repeatedly demonstrated how social networks could be addictive via micro-dopamine discharges, so it is extremely advanced to desert them. As well as, Meta’s apps are additionally extensively used for enterprise causes, which transcend the easy selfie posted by a teen. About Meta’s area, one may speak for hours, however to keep away from being too verbose I most well-liked to focus on solely the overall characters.

Large investments within the metaverse

The billions of {dollars} spent in Meta’s actuality labs section have to this point not been considered favorably by traders. The downsides are usually not solely within the billions leaking out of the stability sheet but additionally within the damaging impacts on profitability: as it’s nonetheless an unprofitable section, it negatively impacts the working margin.

That is in all probability the riskiest part of an funding in Meta, for the reason that firm is actually investing billions in a market nonetheless in its early levels. The potential acquire is incalculable up entrance, as is the loss, however what is definite is that Meta with its billions invested will play an necessary position. The aim of investing a lot cash on this market is to attempt to supply a social expertise that’s as life like as attainable, and that may unite much more individuals situated in other places. Meta has already modified the habits of billions of individuals as soon as with its apps, and with the event of a digital actuality, it may accomplish that as soon as once more. On this facet, Mark Zuckerberg’s phrases are very agency, and there’s no wavering despite the fact that the truth labs section remains to be loss-making:

The metaverse is an enormous alternative for quite a lot of causes. Most significantly, it permits deeper social experiences the place you are feeling a practical sense of presence with different individuals, regardless of the place they’re. By serving to develop these platforms, we’ll have the liberty to construct these experiences the best way we and the general business imagine will likely be finest fairly than being restricted by the constraints that rivals place on us, and our group, and on small companies. Given among the product and enterprise constraints we face now, I really feel much more strongly now that growing these platforms will unlock lots of of billions of {dollars}, if not trillions, over time. That is clearly a really costly endeavor over the subsequent a number of years, however because the metaverse turns into extra necessary in each a part of how we dwell – from our social platforms and leisure, to work and schooling and commerce – I am assured that we’ll be glad that we performed an necessary position in constructing this.

Whether or not this will likely be a trillion-dollar market sooner or later at present nobody can predict. In any case, I believe Meta can afford economically and financially to speculate a lot cash on this space. It’s good to keep in mind that we’re speaking about among the finest firms on the planet, with no debt, and producing $39.11 billion in free money circulate in 2021. Mainly, the corporate may be very stable, so a momentary imbalance to realize extra progress sooner or later I don’t think about it such a significant issue that it could result in a 62{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce} collapse.

Meta’s revenues are not rising

That is the primary difficulty on which traders are interesting with a bearish thesis towards Meta. Meta has been experiencing goal problem in rising its revenues within the final quarter.

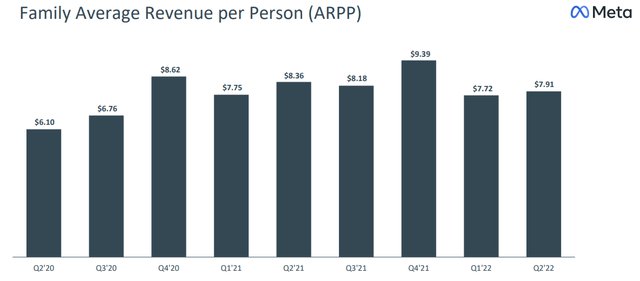

Meta Q2 2022

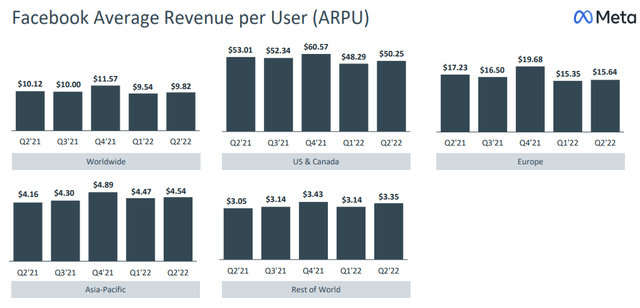

ARPP elevated from the earlier quarter however decreased from the identical quarter final 12 months. this graph, subsequently, it could appear that Meta has reached its progress peak and that the longer term is just not as brilliant because the previous. Personally, on this respect my view is opposite to that of the marketplace for one important purpose: not all geographic areas are experiencing a lower in revenues.

Meta Q2 2022

Analyzing Fb’s revenues by geographic space, in Europe, the U.S., and Canada, the Q2 2022 outcomes had been worse than the earlier 12 months, however the identical can’t be mentioned for Asia-Pacific and Remainder of the World. Since for Meta by way of income the Western financial system has a larger weight than the Jap financial system, the general end result can solely be damaging. Actually, this isn’t a very rosy scenario, however some optimistic points corresponding to progress in different geographical areas shouldn’t be neglected.

Moreover, it’s good to place into context the macroeconomic surroundings that the most important Western economies are going through. The U.S., Canada, and Europe are battling excessive inflation and slower-than-expected financial progress. Extra particularly, excessive vitality costs are slowly crumbling Europe, whereas GDP within the U.S. has been declining for two consecutive quarters. This isn’t the article the place I cowl the present macroeconomic difficulties intimately, however it’s clear that many firms are usually not doing nicely. Since 98{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce} of Meta’s income comes from promoting, it’s not stunning that in a recession some firms resolve to scale back some variable prices corresponding to promoting. Meta’s enterprise mannequin is pro-cyclical, so it’s regular to anticipate a slowdown at this stage.

The query to ask is just not whether or not Meta has stopped rising, however how lengthy this recessionary section will final and the way it will have an effect on money flows within the quick to medium time period. From a long-term perspective (when the financial system recovers), I’m looking forward to a resumption of income progress since customers are usually not dropping, however to be able to make an excellent funding, it’s important to purchase Meta at a worth that may low cost the difficulties of this antagonistic financial section.

How a lot is Meta price?

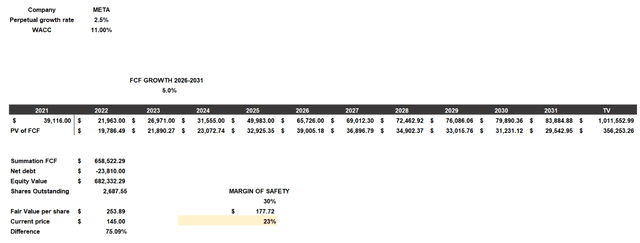

To acquire an approximate honest worth I’ll use a free money circulate mannequin. This mannequin will likely be constructed as follows:

- The price of fairness will likely be 11{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce} and features a beta of 1.30, a risk-free charge of three.50{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce}, nation market danger premium of 4.20{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce} and extra dangers of two{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce}. The latter worth refers to dangers associated to funding within the metaverse.

- Since Meta has damaging web debt, there isn’t a have to calculate the price of debt. The capital construction will likely be composed of 100{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce} fairness and subsequently the WACC will likely be equal to the price of fairness.

- The free money circulate values entered from 2022 to 2026 are based mostly on TIKR Terminal analysts’ expectations. From 2026 I’ve included a progress charge of solely 5{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce} since I wish to preserve a conservative strategy.

- The supply of web debt and excellent shares is TIKR Terminal.

Discounted money circulate

In response to my assumptions, Meta’s honest worth is $253 per share, so the corporate may be very undervalued. Coming into a 30{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce} margin of security this appears to be a wonderful time to construct a place. Reconnecting with what I mentioned originally of the article, the honest worth is someplace between the present worth and the all-time excessive in 2021. At $385 per share, Meta was overvalued, however a drop to $145 I don’t think about justified.

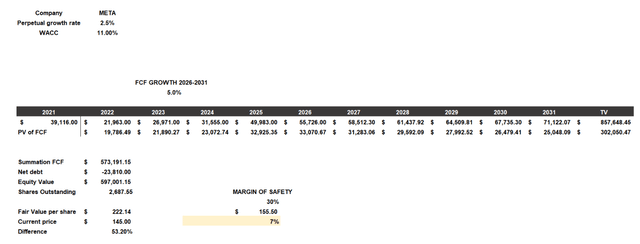

Lastly, earlier than concluding this text I connect a further free money circulate mannequin the place I will likely be much more conservative. The one distinction with the earlier one is within the 2026 money flows which have been decreased by $10 billion: analysts have estimated excessive progress in comparison with 2025, and I don’t belief that determine.

Discounted money circulate

Even utilizing this different, extra conservative mannequin, Meta remains to be very undervalued. The 30{4d1962118177784b99a3354f70d01b62c0ba82c6c697976a768b451038a0f9ce} margin of security nonetheless marks a optimistic worth and a possible entry level at present costs.